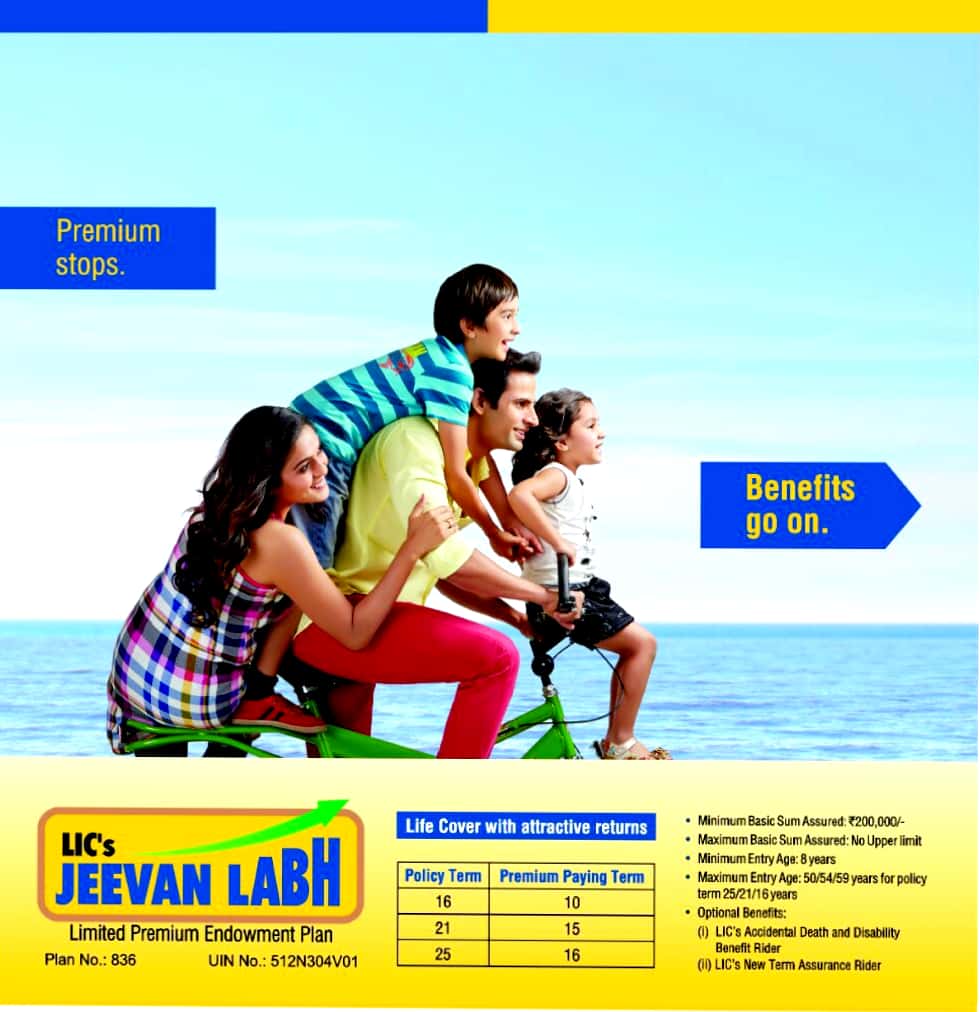

Jeevan Labh Plan (T-936)

Life Insurance Jeevan Labh Plan (T-936) is a Limited Premium Paying with Profits Endowment Plan which is suitable for creating a big corpus for children’s marriage purpose. Policyholder can choose to pay premium for 10 years and maturity at 16 th year (Free Risk Cover for 6 years) OR Pay Premium for 15 years and Maturity at 21 st year ( Free Risk Cover for 6 years) OR Pay Premium for 16 years and Maturity at 25 th year (Free Risk Cover for 9 years).

Why Should I Invest in Insurance Jeevan Labh Plan:

- Cover wide age group from 08 to 59 years.

- Starting Early Enables to Build a Big Corpus with Small Savings.

- To Beat Inflation.

- To Ensure Your Financial Stability in Future.

- To Achieve Your Financial Goals.

- To Ensure Financial Stability For Your Dependents.

- Short Term And Long Term Both Options Available.

- Eligible for Bonuses and Final Addition Bonuses declared by Insurance .

- Term Rider Benefit Available.

- Double Accident Rider Available.

- PWB Rider is also available in this plan for minors.

- Double Tax Benefit Available (Premium Paid gives 80C Tax Benefit upto Rs. 1,50,000 and Maturity is also Tax Free under section 10(10D)).

- Loan and Surrender Facility Available.

Maturity Benefit:

- On completion of policy term, Sum Assured + Bonus + Final Addition Bonus will be paid as maturity.

Death Claim Benefit:

- In case of death during policy term of the plan, Sum Assured Along With Bonus and Final Addition Bonus Will Be Paid to the Nominee.

Eligibility Criteria:

| Minimum Age to Apply | 8 Years (Completed) | |||

| Maximum Age to Apply |

| |||

| Policy Term (Premium Payment Term) | 16(10), 21(15), 25(16) | |||

| Maximum Maturity Age | 75 Years | |||

| Premium Paying Mode | Yearly, Half Yearly, Quarterly, Monthly(ECS) | |||

| Basic Sum Assured | 2,00,000 and above (in multiple of 10,000) | |||

| Loan | After 3 years | |||

| Surrender | After 3 years of full premium payment |