Cancer Cover Plan (T-905)

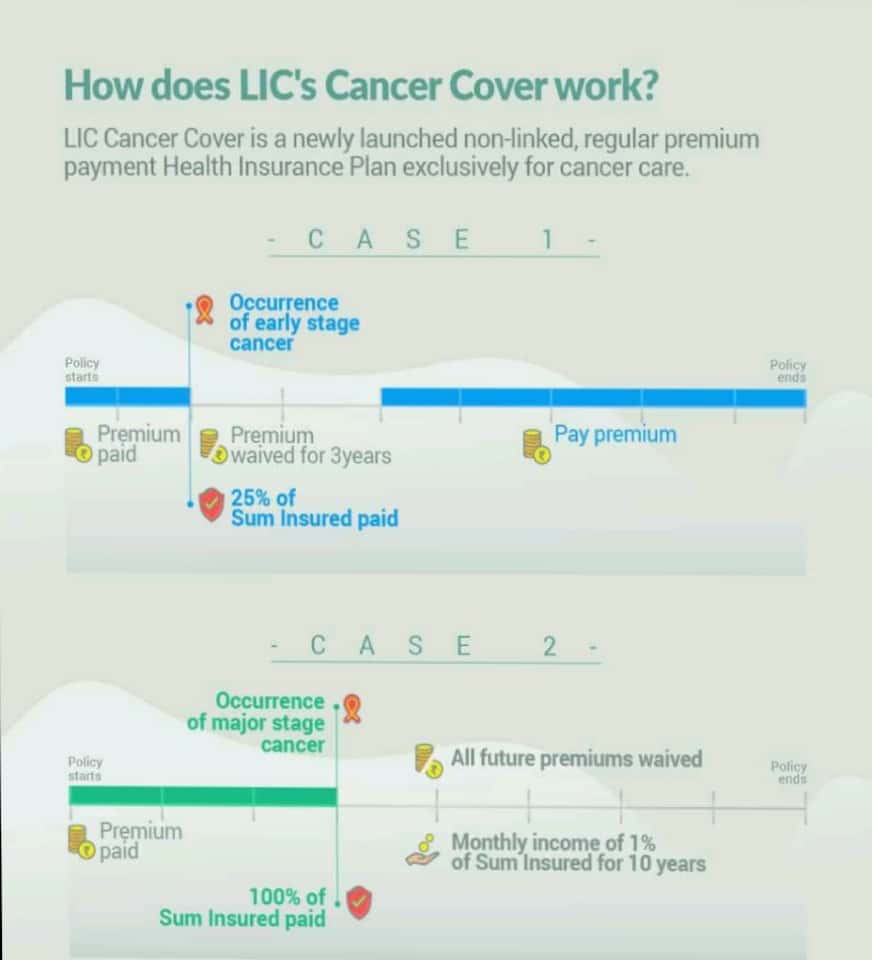

Life Insurance Cancer Care Plan (T-905) is a non linked regular premium Health Insurance Plan which provides fixed benefits in case of Life Assured is diagnosed with any of the specified early cancer or major stage cancer during the term of the policy.

Key Features

- Best plan in the scenario of increasing health ailments like a major disease cancer.

- Level sum assured & increasing sum assured two options are available to be selected by life assured.

- In Level sum assured basic sum assured will remain same during the policy term.

- In Increasing sum assured- Sum Assured increases by 10% of basic sum assured every year for first five years or until diagnosis of first event of cancer, whichever is earlier.

- Covers for two types of cancer i.e. Early Stage Cancer and Major Stage Cancer are available.

- On detection of cancer for early stage 25% of applicable sum assured will be given to life assured immediately and next 3 years premium will be waived off.

- On detection of cancer for major stage 100% of applicable sum assured will be given to life assured immediately and in addition to that 1% of applicable sum assured will be given every month to the life assured for the next 10 years (120 Months ) and all the future premiums will be waived off.

- Income tax rebate up to ₹ 55,000 under section 80D and for lump-sum benefits/income benefit of 10% under section 10(10D).

- Payment of claim will be directly by claim department of LIC and not by any TPA so easy and hassle free process of claim settlement. Also claim should be intimated within 120 days & will be settled by LIC within 30/45 days of receipt of all requirements.

- Premium Waiver Benefit along with claim reimbursement.

- A waiting period of 180 days will apply from date of commencement of policy.

Eligibility Criteria

| Minimum Age to Apply | 20 Years (Completed) |

| Maximum Age to Apply | 65 Years (Last Birthday) |

| Policy Term | 10 to 30 Years |

| Minimum Cover Ceasing Age | 50 Years (Last Birthday) |

| Maximum Cover Ceasing Age | 75 Years (Last Birthday) |

| Premium Paying Mode | Yearly and Half Yearly only |

| Minimum Basic Sum Assured | 10 Lakhs |

| Maximum Basic Sum Assured | 50 Lakhs |

| Types of sum assured | Level sum assured (Sum assured remains unchanged during the term) |

| Increasing sum assured(Sum assured increases 10% every year for first 5 years/diagnosis) |